Employee Retirement Resources

Who is Granite Financial Partners?

Granite Financial Partners is the registered investment advisor of your 401(k) plan. Our role is to educate participants on the plan features and the importance of saving for retirement. As independent accredited investment fiduciaries, we work with participants to help meet their retirement goals.

Who is BPAS?

Benefit Plan Administrative Services (BPAS) is the custodian and recordkeeper of your 401(k) assets. Logging into your account will give you access to updating your deferral rate, allocating your funds to specific investments and updating your beneficiaries.

Call BPAS. 1-866-401-5272. Hours are Monday – Friday between 8:00 am – 8:00 pm ET.

How do I enroll?

Once you have met the eligibility requirements of your employer, you will receive notification with instructions for logging into your BPAS portal. Please reach out to your HR Manager with plan highlights. Granite Financial Partners is also a resource for any 401(k) questions.

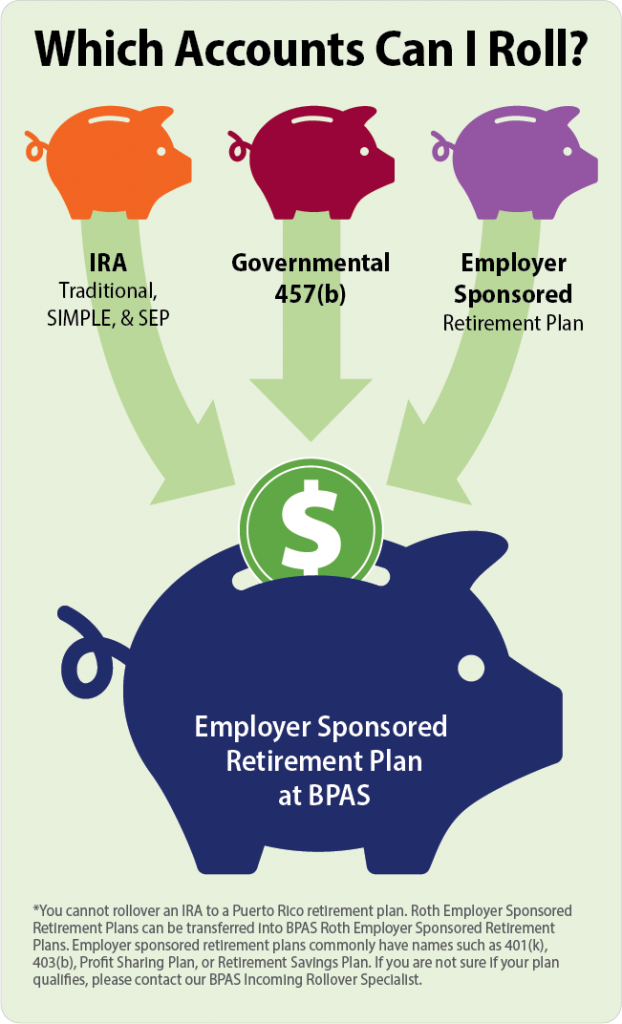

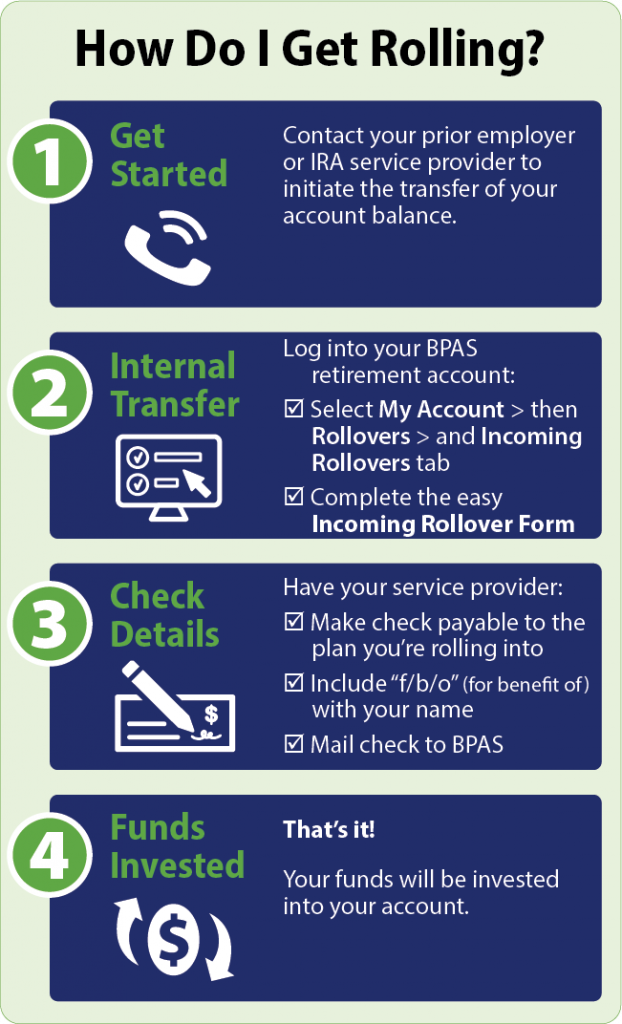

Can I consolidate multiple retirement accounts?

Keep track of your financial future by consolidating them into your BPAS plan. Having your account under one roof not only makes it easier to manage, it helps you see your full financial picture in one snapshot. An easy-to-follow rollover process with access to a specialist along the way.

What’s the difference between a traditional 401(k) Deferral and a Roth 401(k) Deferral??

The biggest difference between a Roth 401(k) and a traditional, pre-tax 401(k) is when you pay taxes. Roth 401(k)s are funded with after-tax money that you can withdraw tax-free once you reach retirement age. A traditional 401(k) allows you to make contributions before taxes, but you’ll pay income tax on the distributions in retirement.

What is the maximum I can contribution for 2024?

The 401(k) contribution limit for 2024 is $23,000 for employee contributions. If you’re age 50 or older, you’re eligible for an additional $7,500 in catch-up contributions, raising your employee contribution limit to $30,500.

Under what circumstances can I withdraw from 401(k) without penalty?

Here are the ways to take a penalty-free hardship withdrawal from your IRA or 401(k) Plan:

How is 401(k) distributed after retirement?

When you retire, you have several options for your 401(k) savings, including leaving the money in the plan, transferring it to an IRA, withdrawing a lump sum, converting it into an annuity, or taking required minimum distributions at age 73.